Survey Software / Types of survey

Types of survey

There are many survey types that allow you to connect with your audience to get the feedback that drives action.

We advise combining some of these methods together to give you the best chance of reaching more people, because not every channel is suited to every audience.

Here’s a breakdown of the types of surveys and how best to use them.

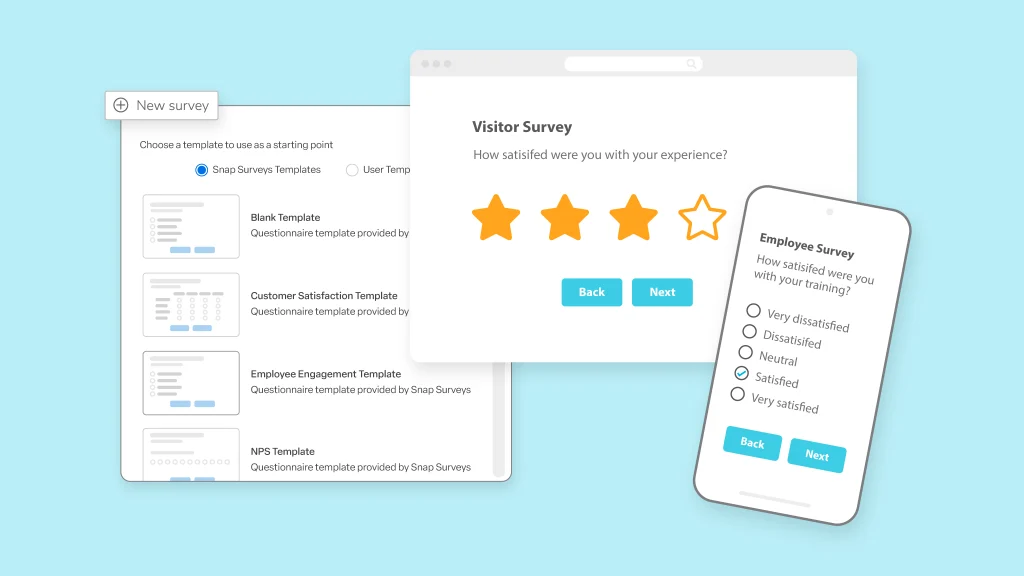

Online Surveys

Online surveys provide an efficient and cost-effective way to reach a large audience. Using a survey platform, you can design engaging questionnaires with a variety of question types and distribute them widely.

Once responses are collected, the data can be analysed and transformed into meaningful reports.

Pros

- Cost-effective: Much cheaper than face-to-face or phone interviews, with no printing or postage costs.

- Quick turnaround: Large numbers of responses collected in hours or days.

- Scalable reach: Target participants across geographies and demographics, particularly with online panels.

- Convenient for -articipants: People complete surveys at their own pace and on any device.

- Automated data collection: Results are instantly stored, coded, and available for analysis. Helping to reduce human error.

- Flexible design: Easy to include multimedia (images, videos, audio) and apply skip logic or branching.

Cons

- Sampling bias: Excludes those without internet access or low digital literacy, leading to unrepresentative samples.

- Low response rates: Many people ignore survey invites, which can skew results.

- Quality issues: Risk of inattentive participants, speeding through, or bots providing unreliable answers.

- Limited depth: Unlike interviews or focus groups, surveys don’t allow probing or nuanced follow-ups.

- Technical Issues: You may encounter problems like content not loading or low internet speed.

- Privacy concerns: Participants may hesitate to share honest answers if unsure how their data will be used, so this information should be stated on the first page of your survey.

Offline Surveys

Offline surveys include paper questionnaires, kiosks, face-to-face interviews, or digital devices that operate without a stable internet connection and sync data later. They can be designed online using a survey platform, then distributed through offline methods.

This approach helps you reach participants who are less digitally connected or in environments where online feedback is impractical.

Pros

- Reach beyond digital access: Includes participants without internet access, useful in rural areas, developing regions, or older demographics.

- Higher response rates: Face-to-face or phone surveys often yield more participation than online surveys.

- Richer data quality: Interviewers can clarify questions, probe deeper, and reduce misunderstandings.

- Trust and engagement: Participants may be more open when speaking to a person rather than filling out an online form.

- Better control of environment: Researchers can ensure the survey is completed properly and avoid bots or inattentive responses.

- Visual and observational insights: In-person surveys allow researchers to observe non-verbal cues or contextual factors.

Cons

- Costly: Printing, postage, or employing interviewers is significantly more expensive than digital options.

- Time-consuming: Data collection and manual entry take longer, delaying analysis and results.

- Limited scalability: Harder to reach large, geographically dispersed populations.

- Human error: Risk of interviewer bias, mis-recorded responses, or inconsistent delivery of questions.

- Respondent burden: Paper forms can feel tedious, and face-to-face interactions may cause social desirability bias (people giving “acceptable” answers).

- Data processing delays: Manual data input adds an extra step before insights can be generated.

Email Surveys

Email surveys include questionnaires embedded directly within an email, such as a single NPS question, or links to full online surveys distributed by email.

Often, the email presents the first question to engage recipients before directing them to the main survey via a link. This approach effectively increases participation, as respondents are more likely to continue once they have answered the initial question.

Pros

- Cost-effective: No printing or postage costs; distribution is essentially free at scale.

- Wide reach: Can quickly reach large, targeted groups, especially if you already have a customer mailing list.

- Convenient for participants: People can complete the survey at their own time, on any device.

- Personalisation: Emails can be tailored with names, segments, or past interactions to boost response rates.

- Trackable engagement: You can monitor open rates, click-through rates, and completion rates.

- Fast Results: Responses typically start coming in within hours or days of sending.

Cons

- Low response rates: Many recipients ignore survey emails, especially if they resemble marketing spam.

- Sampling bias: Only reaches people with active email accounts, excluding others (e.g., those less digitally engaged).

- Deliverability Issues: Surveys may get caught in spam filters or blocked by firewalls.

- Email Fatigue: Sending too many email requests can frustrate customers and reduce participation.

- Privacy Concerns: If data protection practices aren’t clearly stated in the email, participants may hesitate to click links or share information.

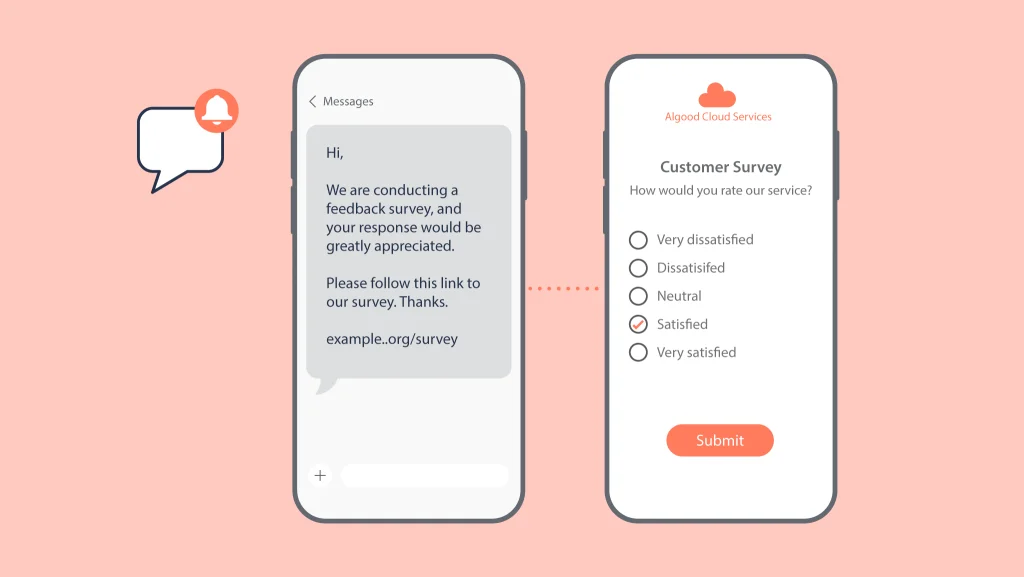

SMS Surveys

SMS surveys collect feedback by sending questions directly to participants’ mobile phones via text message. They are short, quick, and easy to answer, usually limited to a few questions or a rating scale.

Because text messages are typically opened within minutes, SMS surveys are ideal for capturing real-time feedback after a purchase, customer service interaction, or event. They can also serve as a distribution method by including a link that takes the recipient to an online survey page.

Pros

- High open rates: Text messages are read far more often than emails (often above 90%).

- Fast responses: People typically respond within minutes, making SMS great for real-time feedback (e.g., after a service interaction).

- Wide accessibility: Can reach people without smartphones, apps, or internet access – just a basic mobile phone is sufficient. They are also easy to complete as they’re usually short surveys, helping to boost response rates.

- Convenient and simple: Short, direct questions are easy to answer on the go.

- Short surveys: Perfect for pulse checks, quick polls, or customer satisfaction ratings.

Cons

- Limited length: Messages must be very short; complex or long surveys don’t work well.

- Response fatigue: Too many texts can annoy participants and lead to opt-outs.

- Sampling bias: Not everyone is comfortable sharing opinions by SMS, and some demographics may ignore texts from unknown numbers.

- Costs: Sending bulk SMS can be more expensive than email, and international messaging costs may add up.

- Privacy and trust: Some recipients may worry about scams or phishing, making them hesitant to click links in your text.

- Limited data: Text responses are often brief, limiting depth compared to interviews or online surveys.

Paper Surveys

Paper surveys are created within a survey platform and printed for distribution by mail or in person. Participants complete them by hand and return them to the survey management team.

This method helps reach seldom-heard groups without reliable internet access or digital devices, improving response rates and providing more comprehensive insights.

Pros

- Inclusive: useful for populations with limited internet or mobile access.

- Familiarity: many participants (especially older demographics) are comfortable with paper formats.

- No Digital Barriers: avoids issues like spam filters, software compatibility, or low digital literacy.

- Response Rates: when handed out in person (during classes, events, or meetings), people are more likely to complete them immediately.

- Readability: easier to manage when participants need to see all questions at once rather than scrolling digitally.

Cons

- Data Entry: responses must be manually input into a system, increasing cost and risk of human error.

- Slower Turnaround: collection, return, and processing take longer compared to online or SMS surveys.

- Higher Costs: printing, distribution, and mailing can be expensive.

- Limited Reach: harder to scale across large or geographically spread populations.

- Return Rates: mailed paper surveys often have poor response unless incentivized.

- Environmental Concerns: printing uses paper and resources, which can be less sustainable.

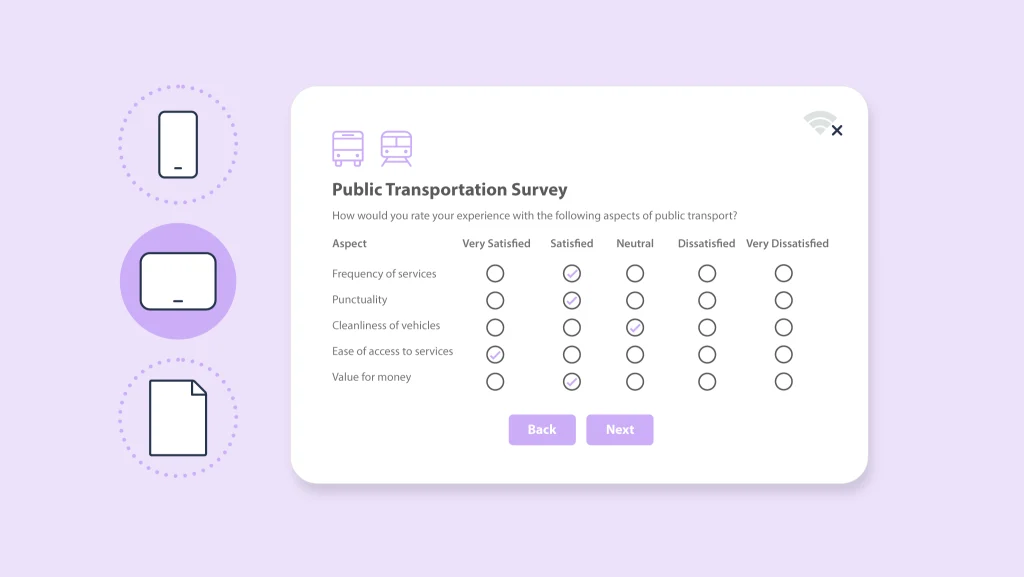

Kiosk Surveys

Kiosk surveys are distributed to participants through a digital touch-screen device (such as a tablet) placed in a physical location such as a store, hospital, or event venue. They allow people to quickly share their opinions or experiences on-site, often immediately after an interaction.

Kiosks are great for collecting real-time, location-specific feedback in a convenient and interactive way for the participant.

Pros

- Real-time feedback: captures opinions immediately after the customer experience, increasing accuracy.

- Get attention: placed in strategic, high-traffic areas (stores, hospitals, airports) encourages easy participation.

- User friendly: use of touchscreens makes surveys quick, simple, and engaging for participants.

- Automated data collection: responses are stored in your survey platform, reducing manual entry errors.

- Customisable: kiosks can include branding, visuals, and multimedia to enhance engagement and drive brand recognition.

Cons

- Set-up cost: purchasing or leasing kiosks/tablets and maintaining them can be expensive.

- Restricted reach: only collects feedback from people in one location at a given time.

- Engagement risks: some people may ignore kiosks if not well-placed or incentivised.

- Maintenance required: hardware/software needs upkeep to avoid breakdowns.

- Security and privacy: participants may be reluctant to answer sensitive questions in a public setting.

Phone Surveys

Phone surveys can involve either a direct one-to-one conversation or be conducted through automated voice systems. This approach allows for more personal interaction than online or SMS surveys, as interviewers can clarify questions or probe deeper into responses.

Phone surveys are often used for customer satisfaction, political polling, or research involving groups that may not have easy internet access.

Pros

- Personal interaction: interviewers can build rapport, clarify questions, and probe for deeper insights.

- Wide reach: accessible to people without internet or smartphone access.

- Higher response rates: compared to email or SMS, especially when conducted by live interviewers.

- Real-time data collection: responses are recorded immediately, which is often done digitally.

- Flexibility: surveys can be adjusted mid-conversation to explore interesting responses.

Cons

- Costly: requires trained interviewers, call centres, or Interactive Voice Response (IVR) systems.

- Time-consuming: each call takes several minutes, limiting the number of participants reached.

- Intrusive: many people dislike unsolicited calls and may refuse to participate or hang up.

- Sampling bias: harder to reach younger audiences or those who rarely answer calls.

- Limited attention span: participants may lose interest if the survey is too long.

Face-to-Face Surveys

Face-to-face surveys involve an interviewer asking questions directly to participants in person, taking places in locations such as homes, shopping centres, events, or public spaces.

This method allows for detailed responses as interviewers can clarify questions, observe body language, and dig deeper for more detail, and especially useful when targeting specific communities or conducting complex research.

While they require a lot of resources, face-to-face surveys are one of the most effective ways to gather high-quality data.

Pros

- High-quality data: interviewers can clarify questions, dig deeper, and capture detailed responses.

- Builds trust: personal interaction often encourages more honest and thoughtful answers.

- Completion rates: people are more likely to complete the full survey when approached in person.

- Non-verbal cues: interviewers can observe body language and context, adding depth to insights.

- Flexibility: surveys can be adapted in the moment if responses lead to new directions.

Cons

- Expensive: requires trained interviewers, travel, and significant time investment.

- Time-consuming: fewer participants can be reached compared to online or phone surveys.

- Potential interviewer bias: the presence or tone of the interviewer may influence responses.

- Geographical reach: limited to areas with higher foot traffic.

- Participant honesty: some people may feel pressured to answer in a socially acceptable way.

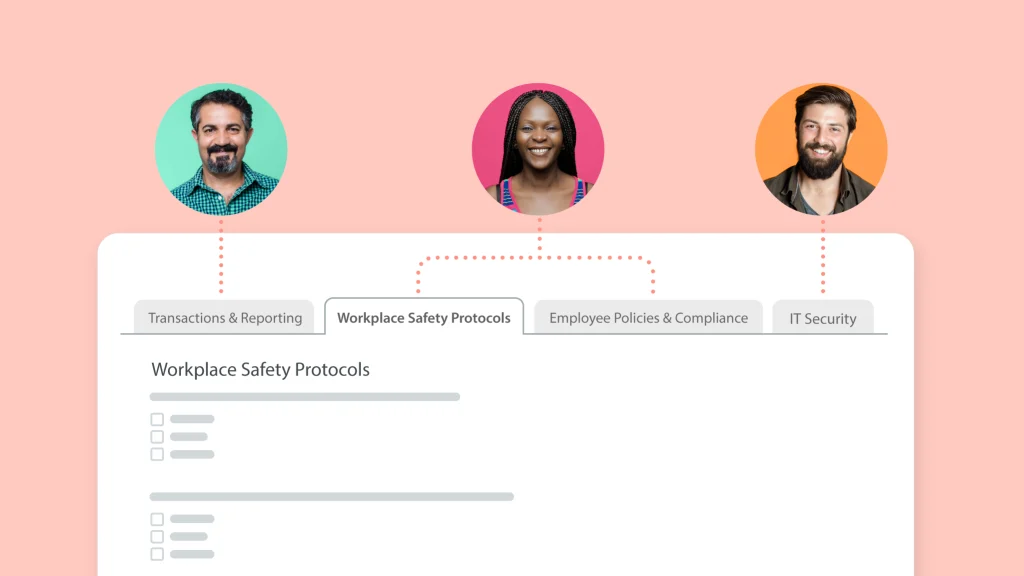

Non-linear Surveys

Non-linear surveys are surveys that don’t have to follow a fixed path through the questions, which can adapt to answers that have been given. This allows participants to skip irrelevant sections (such as employee surveys where they only have to complete sections about their specific department) or branch into different question sets.

The non-linear approach creates a more personalised experience, reduces survey fatigue, and ensures that participants only see relevant questions. Such surveys are commonly used in customer feedback, audits, healthcare assessments, and market research where different respondent groups need different question flows.

Snap XMP Tabbed Surveys are non-linear, allowing multiple people to complete different sections at any time and in any order.

Pros

- Personalised experience: participants only see relevant questions, improving engagement.

- Reduces fatigue: shorter, more focused surveys feel less repetitive and time-consuming.

- Higher Quality Data: avoids irrelevant or confusing questions, leading to more accurate responses.

- Flexibility: branching logic allows tailoring for different audiences, use cases, or scenarios.

- Professional Impression: adaptive design can feel smarter and more participant friendly.

Cons

- Complex Design: requires careful planning and survey software with branching logic capabilities.

- Setup Costs: more time and resources needed to design, test, and implement.

- Analysis Challenges: responses may vary widely depending on pathways, making comparisons harder.

- Risk of Errors: poorly designed logic can cause participants to miss important questions or get stuck.

- Not Always Necessary: for simple or short surveys, non-linear design may overcomplicate things.

Snap XMP – perfect for every type of survey

Create engaging surveys that can be distributed through any channel or method with Snap XMP.

- Survey Design & Distribution

- Analysis & Reports

- Online, Offline, Paper Surveys

- In-house Research Projects Team

- ISO 27001 & Cyber Essentials Plus Certified

- Trusted by BBC, NHS, US Department of Justice

- UK & US-based Support Teams: Live Chat, Email, Phone

Try Snap XMP now for free!

Survey Types FAQ

SMS or kiosk surveys are usually best for real-time feedback. They’re quick and easy to complete, often completed within minutes of an experience or customer interaction.

Face-to-face and phone surveys allow interviewers to dig deeper and clarify answers, making them ideal for gathering richer insights with more detail.

Yes – especially for groups with limited digital access, such as older demographics or those in rural areas. They can be limited in reach due to being labour intensive but can still provide high-quality responses. And with the right survey platform, they can be integrated alongside online survey data for combined analysis.

Non-linear surveys (such as tabbed surveys) adapt questions based on previous answers, skipping irrelevant ones. This keeps surveys shorter, more engaging, and tailored to each participant.

Online and email surveys are typically the cheapest to set up and scale, especially for reaching large audiences quickly.

While they can provide deeper insights, they are also expensive and time consuming, making them harder to scale compared to digital options.

The right survey method depends on your goals and the requirements needed to connect with your audience.

- Speed & scale suits online, email, and SMS surveys.

- Depth & detail requires either face-to-face or phone surveys.

- In-the-moment feedback is suited to kiosk or SMS surveys.

- Limited internet access means paper or phone are the best choices.

Potentially, as in-person surveys allow clarification and reduce misunderstandings. However, they also risk interviewer bias, where participants may feel pressured to answer in socially acceptable ways.